The Moving Average Convergence Divergence indicator, or MACD, is one of the most popular technical analysis indicators. It can help you identify trends, spot signals, and anticipate new ones. It is often profitable to trade at the beginning of a trend, as this is where the best profit can be made. For more information, read this article. You may also want to look at the other technical indicators. However, you can combine them if you wish.

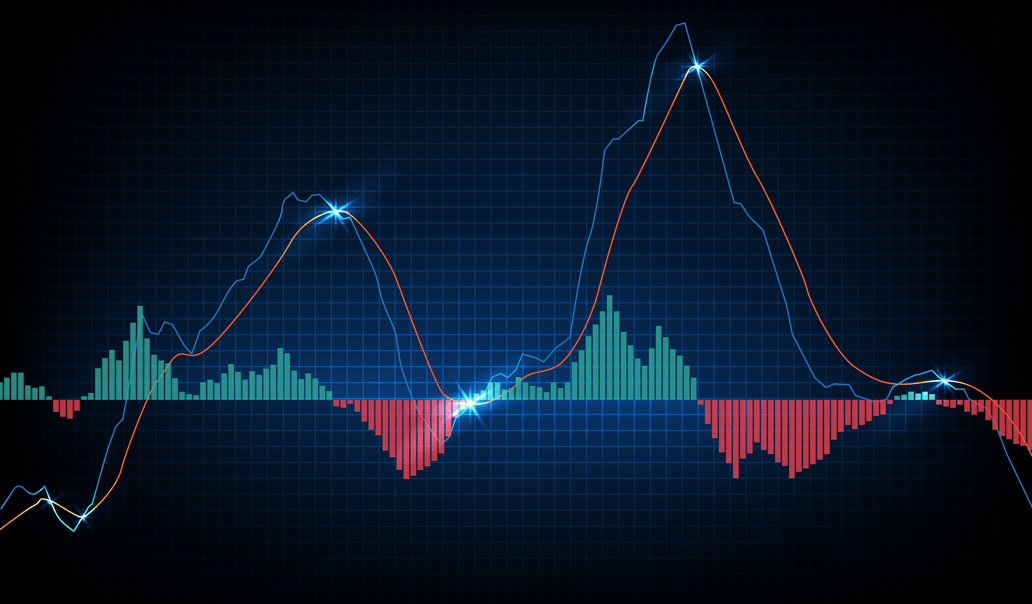

The MACD line crosses its signal line and zero line at specific points. The crossover indicates an uptrend or a downtrend, and potential buy signals are produced when the MACD crosses above or below zero. The MACD line points to a bearish trend when it crosses below zero. This crossover can occur in many different ways, and traders should avoid relying solely on the MACD indicator for trading. It is also important to consider the volatility of the underlying security when using the MACD indicator.

In a nutshell, MACD is a moving average of the difference between two exponential moving averages. The first line is called the MACD line and is plotted as the distance between the two exponential moving averages. As with other oscillators, MACD does not have a standard scale, so it is useful for identifying trends. It can also help you spot reversals. If the MACD line is decreasing, you should sell the asset.

The MACD indicator is based on three time parameters, or exponential moving averages (EMAs). These parameters are typically notated as MACD(a,b,c). The MACD series is the difference between EMAs with different characteristics. This difference allows you to identify subtle changes in the strength of a trend. The MACD signals may require you to correlate them with other indicators like RSI power. These indicators are useful tools to help you make better trading decisions.

If you’re looking for a short-term trading indicator, MACD is one of your best options. It can help you determine when a trend is reversing or continuing to move in either direction. Because it is a short-term indicator, it is especially useful to short-term traders. A good place to start is the Next Generation platform, which offers tight spreads and no hidden fees, and access to more than 10,000 instruments.

Divergence is another important MACD signal. When the indicator moves towards its zero line, this signals a possible reversal. However, it can also be a false positive. Often, it fails to signal a trend reversal because it predicts too many false positives. A divergence between price and MACD is often interpreted as a selling opportunity, as these events usually precede price reversals.

MACD is a lagging indicator, meaning that the indicator is based on past price action, and thus must “lag” the price. However, this does not mean that you should ignore it; instead, use it to spot potential trend changes. If MACD signals a trend change, it’s a good sign that it’s about to happen. That said, you should use MACD to evaluate whether your strategy is working or not.